- #Return on maximum drawdown how to

- #Return on maximum drawdown code

- #Return on maximum drawdown series

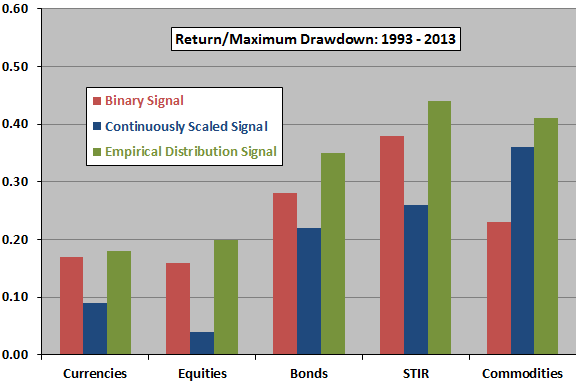

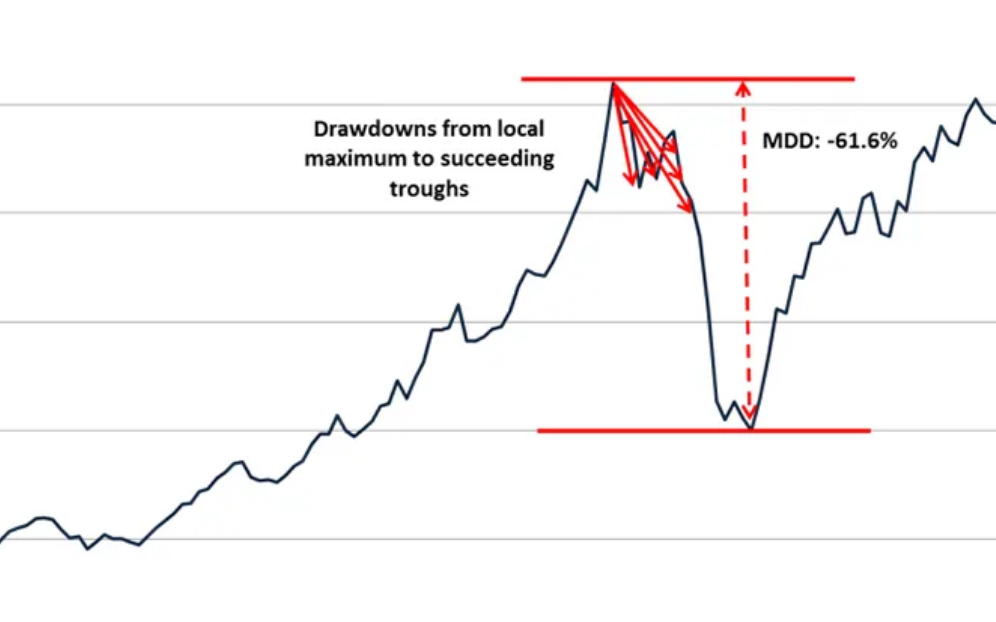

Consequently, asset allocation should be lower when building a portfolio for a more risk-averse investor. There we had:īTC lowest value after peak value = 3178.62īecause the maximum drawdown of BTC is more significant (over four times), we can state that BTC involves much more risk than SPY. On the other hand, Bitcoin experienced its maximum drawdown during December 2017 and December 2018. Therefore, SPY maximum drawdown = -19.33% Tracking max drawdown in live trading helps you understand when your strategy might not be working as expected or you might be in a less than optimal mental state. In backtesting, it shows you the downside risk of a strategy. SPY lowest value after peak value = 222.83 Maximum drawdown is an important trading statistic to track in your backtesting and live trading. You can verify both results in our maximum drawdown calculator.įor the SPY, we have the biggest drawdown to be around March 2020, when the OMS declared the COVID-19 a pandemic disease. Let's evaluate the maximum drawdown of the S&P500 index ETF, the SPY, and compare it to the most famous cryptocurrency, Bitcoin.

# label only the negative part of the underwater NDD stands for negative-side drawdown. 5%ĭictionary containing the start, end dates and duration in months for the maximumĭfw.loc = i.left) & (dfw.index = -threshold else x, min_per_int)))) Threshold (float): only look at drawdowns greater than this in absolute value e.g. Labels all drawdowns larger in absolute value than a threshold and returns theĭrawdown of maximum duration (not the max drawdown necessarily but most often theyĭfw (pd.DataFrame): monthly data, the pre-computed drawdowns or underwater. def max_dur_drawdown(dfw, threshold=0.05): The solution can be easily adapted to find the duration of the maximum drawdown. This solution is tested and works but here I'm computing the maximum duration drawdown and NOT the duration of the maximum drawdown. It could be better to add: xs -= (np.min(xs) - 10) Portfolio optimization using the drawdown has also been considered in 5. Print(f"solution 1: peak \n rate :įurther the price of an asset cannot be negative so xs = np.random.randn(n).cumsum() Label="mdd 2", color='Green', markersize=10) Label="mdd 1", color='Red', markersize=10) At least in Korean asset management industry, a typical investment prospectus and investment report include realized return, volatility, Sharpe Ratio, VaR, and/. Pos_peak2 = np.argmax(xs) # start of period Xs)/np.maximum.accumulate(xs)) # end of the period Pos_min2 = np.argmax((np.maximum.accumulate(xs). Pos_peak1 = np.argmax(xs) # start of period Pos_min1 = np.argmax(np.maximum.accumulate(xs) - xs) # end of the period ( np.maximum.accumulate(xs) - xs ) / np.maximum.accumulate(xs)Ī short example for prooving that formula given by behzad.nouri can produce wrong result. You just need to divide this drop in nominal value by the maximum accumulated amount to get the relative ( % ) drawdown. I = np.argmax(np.maximum.accumulate(xs) - xs) # end of the period

#Return on maximum drawdown code

Related code (from behzad.nouri) below: n = 1000 Recent Corona Virus crisis, drop 33.9%, 1,1148.75 pointsīy applying this method to period after 2000, you'll see Corona Virus Crisis rather than 2007-08 Financial Crisis.

#Return on maximum drawdown series

For example, if you would apply this to time series that is ascending over the long run (for example stock market index S&P 500), the most recent drop in value (higher nominal value drops) will be prioritized over the older decrease in value as long as the drop in nominal value/points is higher. What you end up having is the maximum drop in the nominal value rather than a relative drop in value (percentage drop). S = S0*np.exp(X) # geometric brownian motion #īehzad.nouri solution is very clean, but it's not a maximum drawdow (couldn't comment as I just opened my account and I don't have enough reputation atm). W = np.cumsum(W)*np.sqrt(dt) # standard brownian motion # # create random walk which I want to calculate maximum drawdown for:

#Return on maximum drawdown how to

If anyone knows how to identify the places where the drawdown begins and ends, I'd really appreciate it! import pandas as pd So far I've got code to generate a random time series, and I've got code to calculate the max drawdown. I want to mark the beginning and end of the drawdown on a plot of the timeseries like this: Given a time series, I want to calculate the maximum drawdown, and I also want to locate the beginning and end points of the maximum drawdown so I can calculate the duration.

0 kommentar(er)

0 kommentar(er)